Infrastructures: driver for global construction

The forecast for 2024 is for a slowdown of the global market (+1 against +3,4% in 2023), with major works continuing to be frontrunners

The forecast for 2024 is for a slowdown of the global market (+1 against +3,4% in 2023), with major works continuing to be frontrunners

In 2023, the global construction market experienced growth, particularly in emerging countries like China and India. However, challenges such as geopolitical tensions and tightening monetary policies pose risks. Different regions show varying growth rates. The outlook for the construction sector depends on factors like infrastructure spending, housing market conditions, and geopolitical stability.

Global construction market trends and forecasts

In 2023 the global construction market registered an estimated growth of 3.4%, improving on 2022 which ended the year with an increase in investments of 2.4%. The growth in the building sector was slightly better with respect to growth in the global economy which last year, according to the International Monetary Fund, saw a growth of 3.1%. The graph below shows the historic trend in construction output and the forecasts up to 2025. In 2023 the advanced economies showed a 0.5% increase in the the value of the construction sector, while in the emerging countries growth in the building market was high at around 5.6%.

The forecast for 2024 indicates overall growth in the global building sector of around 1%. The more mature markets should probably see a recession in investments in construction work of an estimated 1.2%, while in emerging countries there should be moderate growth of an estimated 2.6%. The rate of development hypothesised for the global construction sector should be noticeably lower than that of global GDP, and is estimated to be around 3.1%. The economic situation of the global construction market should improve in 2025 when the average annual increase in investments is expected to be 3.3%, with an estimated increase of 4% in emerging countries and of 2.3% in the more developed countries.

The scenario presented is subject to two main risk factors. The first one regards an escalation in the wars in Ukraine and the Middle East. In fact, as these conflicts evolve, the repercussions they could have on the global economy and construction market are difficult to quantify. Another risk factor is the tightening of monetary policies. In fact, the increase in official interest rates and the resulting inflexibility of credit conditions for families and businesses represent a significant risk for maintaining growth. For the various components of the global construction market the trends are expected to differ. The energy and infrastructure sectors have benefitted over the course of the last few years from this positive trend. The infrastructure sector profited from the considerable public resources made available to relaunch the economy and the construction industry in the period following the pandemic. The outlook for the public works sector is positive up until 2027. The forecast for the sector of the construction industry involved in energy projects is feeling the positive effect of funds allocated to promote environmental sustainability and ecological transition. Investments in the energy and utilities sector, therefore, should enjoy a positive economic situation in the long term. For the non-residential sectors (commercial, industrial and institutional) there is expected to be moderate growth in investments, with its dynamic being directly influenced by the trend of the global economy. The residential sector is the only one for which a contraction in global investments is expected in the two-year period 2023-2024. House building is going through a rather modest economic situation in China, the US and Western Europe and modest growth in the sector is only expected from the following year.

Asia Pacific

In 2023 this region, which accounts for 52% of the global building sector value, registered an estimated growth in construction output of almost 6%. The forecast for the current year indicates a net slowdown in the rate of development in the building market, which should remain lower than 3%. The forecast for 2025 indicates an increase in investments in construction work of 3.6%. In China, the leading nation in the world when it comes to the value of investements in the construction sector, the building sector continued to grow in 2023 by 6.5%, slightly higher than the 5.5% registerd in the previous year. In 2024 the construction market is expected to grow by 2.8%. Behind this restraint in the rate of growth is the recession in investments in the house-building sector, caused by measures taken by the Chinese government to prevent the real-estate bubble bursting due to an over-production of houses and excessive price rises. This negative economic situation in the house-building sector should be counteracted by a very positive dynamic in the infrastructure setor, sustained by massive investmensts in the transport sector and by funds from the green power transformation plan, a long-term programme to achieve ambitious ecological transition objectives. For next year there is a moderately positive outlook for the Chinese construction sector, with investments expecting to grow by 3.4%.

The Indian building market is the 3rd largest in the world in terms of size with a value of nearly 700 billion US dollars. In 2023 the Indian construction sector registered one of the best performances at global level; in fact, investments grew by almost 10%, with both the infrastructure sector and the residential sector benefitting from the positive economic conditions. It is believed that the positive dynamic of the market could continue into the 2024-2025 period, during which an annual growth rate of a little lower than 6% is expected. In Japan, the main market in the North-East Asia region, the building sector grew in 2023 by almost 1%, registering a performance in line with the average of the more mature markets. The economic situation of the building sector is expected to remain modest for the next two years and the rate of growth in investments will not exceed 1%.

Last year the Australian building sector benefitted from a positive dynamic due to public sending in the infrastructure sector. The Australian market is 14th in the world in terms of investments, an estimated 171 billion dollars. For the next two-year period average market growth should be around 1.6%, so maintaining a higher level than the average of the more mature markets, which is estimated to be just 0.6%.

Western Europe

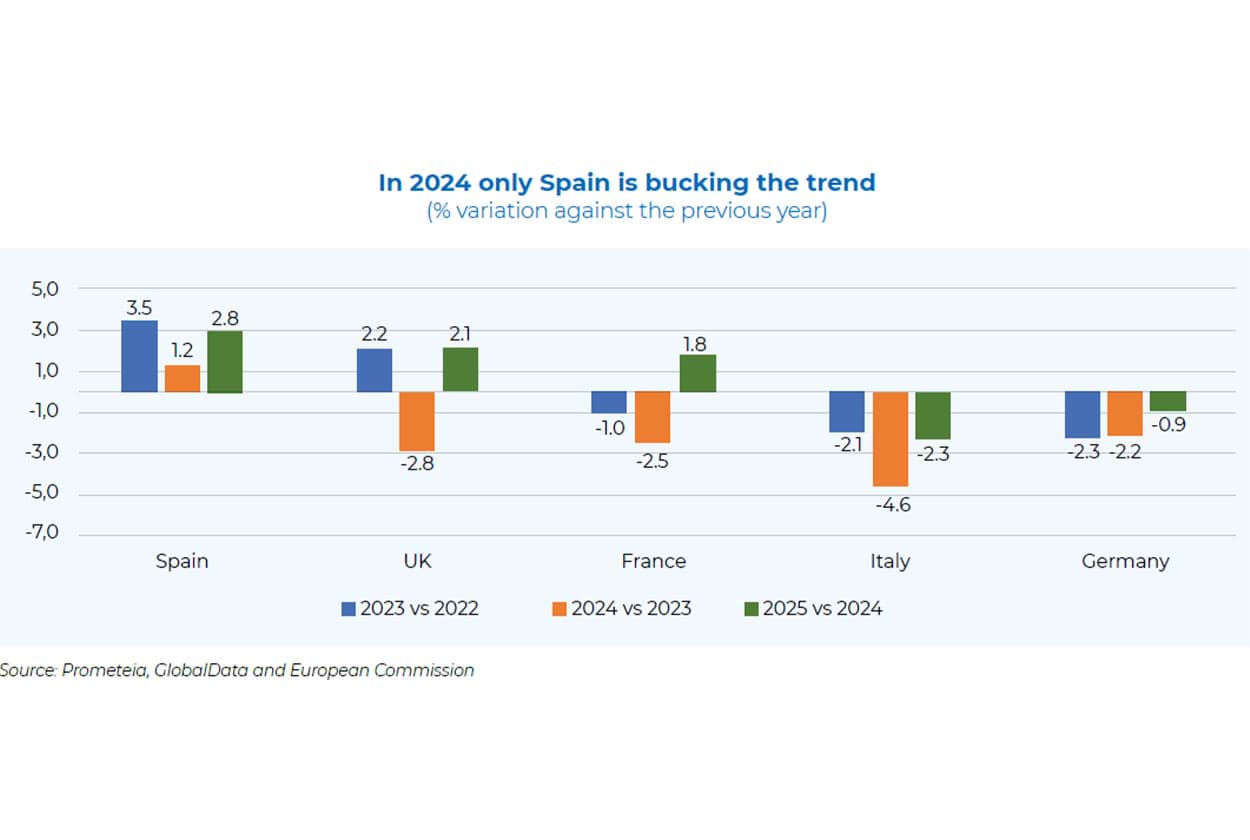

In 2023 this was the only region to have seen a decline in investments in construction work, measuring 0.6%. The three sectors of the building market had different trends: a net recession in the housing sector, stagnation in the non-residential sector and an increase in investments in the infrastructure sector. For the current year, the dynamic for construction output should register a net contraction and there is expected to be a market recession of more than 3%. It is estimated that there could be a moderate growth in investments starting from 2025. .The five strongest economies in Europe generate more than 3/4 of the continent’s construction output. The graph below shows the most recent estimates for the construction sector for the area’s top markets. Note that the variations are based on “constant values” and exclude the effects of inflation in the construction sector.

The Spanish building sector in 2023 was best performer in Western Europe’s construction market, with investments growing by an estimated 3.5%. The outlook for 2024-2025 is positive and the construction sector could grow at an average annual rate of 1.5%. For the housing and non-residential sector growth is forecast to be modest, while a more positive dynamic for the infrastructure sector is hypothesised.

The UK building sector is considered to have had an overall positive trend in 2023. Investments in construction work increased by around 2%, against an average contraction of around 0.6% in Western Europe. The current year should register a recession in the building market of an estimated 2%, which will be, nonetheless, less intense compared with the average for Western Europe. The market could start growing again, albeit modestly, starting from next year.

The French construction market is the 6th largest in the world in terms of size and has an estimated value of 341 billion Euros. Last year the construction industry suffered a slight contraction in investments, which should continue and even worsen in 2024. The estimates for 2025 indicate moderate growth, in line with the levels forecast for the construction market in Western Europe.

In 2023 Germany suffered the most marked recession in the construction industry amongst the major markets of the area. Estimates for 2024 and 2025 point to a continuation of this recessive phase in the building sector. The overall trend for the construction sector will be penalised by the housing sector, for which in the period being considered there is expected to be a net squeeze on investments.

Last year investments in construction work in Italy registered a drop of an estimated 2%. This figure should be read in the light of the particularly strong growth the market registered in 2022, when investments grew by more than 12%. In 2023 the home renovation sector contracted due to funds for tax incentives progressively running out. Investments in the non-residential sector saw a moderate decline, influenced also by the modest economic situation (in 2023 GDP grew by 0.7%), whereas infrastructures was the most dynamic component of the market, registering an estimated 6% growth. Forecasts for 2024-2025 point to an average annual contraction in the construction sector of around 3.5%. The sector most in crisis will be that of home renovations, for which there is expected to be a “double-digit” contraction in both 2024 and 2025. Modest growth in investments is forecast for the non-residential sector, while strong growth in the public works sector should be maintained, thanks to funds from the PNRR (National Relaunch and Resilience Plan), at an estimated average rate of more than 7%.

Eastern Europe

Last year this region registered a high rate of growth in investments in construction work, an estimated 4.8%. This positive dynamic in the construction sector benefitted from the surprising growth capacity of the Russian market, the largest in the area and 11th in the world for value of investments. In fact, estimates point to an increase of 6.6% for Russian construction output in 2023. Starting from Q4 last year, however, the Russian constuction sector seems to be suffering more heavily from the sanctions that have been imposed, along with the cost of raw materials and the rise in mortgage interest rates. As such, estimates for 2024 indicate a year of net recession.

In 2023 Poland and Turkey – the other two major markets in the area – registered a growth in construction output. For many years the Polish market was one of the most dynamic at European level. Last year, too, the value of the construction sector saw a modest increase and, based on recent estimates, the rate of growth in investments should progressively strengthen. The main market driver will be the infrastructure sector, for which the outlook is very positive. For the next two-year period, on the other hand, the housing sector should be facing more modest economic conditions. The Turkish construction market has an estimated value of 115 billion dollars, the second largest in terms of size in Eastern Europe. Last year investments in construction work in Turkey grew by 5.1%, a rate in line with the average for the eastern region. Analysts believe that a growth in interest rates and a devaluation of the Turkish Lira will make it more difficult to finance the country’s ongoing large-scale infrastructure projects and, as a result, 2024-2025 should register more moderates rates of growth in investments for construction work, estimated to be 2.3% annually.

North America

The US and Canada are, respectively, the 2nd and 8th largest construction markets in the world with an estimated value of 1,579 billion US dollars for the US building sector and 294 billion US dollars for the Canadian sector. Analysts believe that, last year, the vaue of investments in construction work in the USA grew at a rate of 1%. Inflationistic pressures, high interest rates and an increase in the cost of construction work had a negative impact on output in the residential building sector. The public works sector, on the other hand, benefitted from a massive public investment programme in infrastructures. In 2024 the economic situation in the residential sector should also be impacted by the factors that conditioned growth last year. The overall value of the construction market will continue to register moderate growth, estimated to be 1.5%, thanks to the contribution for the infrastructure sector and the non-residential building sector. Analysts believe that, from 2025, the residential sector could start growing again, taking US construction output to a high growth rate of an estimated 4%.

For the Canadian housing sector estimates point to a negative trend for 2023 and 2024, similar to that of the United States. In Canada indications also point to the public works sector as being the most dynamic in the building market but, unlike the USA, investements in infrastructures will not prevent an overall recession verified in the construction market in 2023, and which is also expected for the current year. Forecasts indicate that starting only from 2025 could Canadian construction output start growing again, albeit modestly.

Latin America

Last year this region registered a modest increase in investments in the construction sector with an estimated growth rate of 1.6%. In Brazil, the main market in the area and the 13th largest in the world, the recession in the construction sector weighed heavily on the economic situation of the region. In fact, it is estimated that, in 2023, the Brazilian construction industry contracted by 2.5%, the effect of high labour costs, high interest rates and restrictive fiscal policies. A further market contraction of around 2% is forecast for the current year. Only in 2025 could the Brazilian building sector be in a position to overcome this recessive phase.

The Mexican construction market is the 2nd largest in Latin America and the 16th largest at global level with an estimated value in 2023 of 146 billion dollars. Last year the Mexican building industry showed a highly positive dynamic, registering “double-digit” growth in investments. In 2014 the value of construction output is expected to contract due to several large infrastruture projects being completed and the effect of factors penalising the global building industry (inflation in the construction sector and high interest rates). For the current year the recession in the Mexican and Brazilian markets will lead to an overall fall in investments in the construction industry in Latin America.

The dynamic of the construction industry is also estimated to be modest in the other main markets in the region, Argentina, Colombia and Chile. The trend for investments in construction work in Argentina is due to the high level of uncertaintly, and the possibility of an upturn in the market depends on the new President’s capacity to overcome the serious economic crisis afflicting the country.